How to view your PF balance online ?

Anyone who has gone to an Employees Provident Fund office knows the hassles associated with the same , with technology being advanced even this process have move online . So no more queues or half-day leaves or foot wear being worn down for withdrawing your PF money or submitting Form -11 or transferring of PF details .

When I linked the same and started using this facility four months back , I went through multiple links to get it done , when I asked my friends about this many if them didn't know such a facility existed . That is why I have written a step by step guide to follow with which anyone can know their PF details online .

Pre-requisites : P.F No., U.A.N No , P.A.N Card

Aadhar Number would be needed if you want to link the same

How to get your P.F number

1) You can get your P.F number from your pay slip

Steps to display of balance online

How to get your U.A.N

Most people would not have activated / created your U.A.N .I hadn't even heard about it before . So I will include the steps to create activate the U.A.N as well

What is U.A.N ?

1) Go-to UAN Member Portal & Select Activate UAN

2) Select the Second radio button member ID [Member ID is your P.F number split the P.F number according to the permitted tabs in the member ID . Refer P.F number above if you have doubts]

When I linked the same and started using this facility four months back , I went through multiple links to get it done , when I asked my friends about this many if them didn't know such a facility existed . That is why I have written a step by step guide to follow with which anyone can know their PF details online .

Pre-requisites : P.F No., U.A.N No , P.A.N Card

Aadhar Number would be needed if you want to link the same

How to get your P.F number

1) You can get your P.F number from your pay slip

Here I have attached a sample payslip

2) Ask for the same to the HR / Finance person whoever is approachable . Ideally the H.R , Finance if yours is a Flat Organization

What is P.F Number ?

The fields that form the PF account number are identifiers for the region, the employer and the employee.

Example : KN/KRP/98471/000/9538752

KN stands for Karnataka tell us that this account is held in the state of Karnataka.

KRP stands for K R Puram EPF office.

98471 is the identification number for the firm / employer

000 is part of the account number also indicates information about the region where the PF is held.

9538752 is the PF account number assigned to the employee.

It is important to remember that the reason you get a new PF number every time you change jobs is that each establishment you work for will have a unique code attached to it

Steps to display of balance online

How to get your U.A.N

Most people would not have activated / created your U.A.N .I hadn't even heard about it before . So I will include the steps to create activate the U.A.N as well

What is U.A.N ?

1) Go-to UAN Member Portal & Select Activate UAN

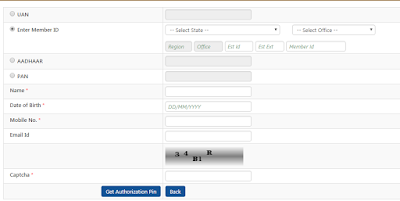

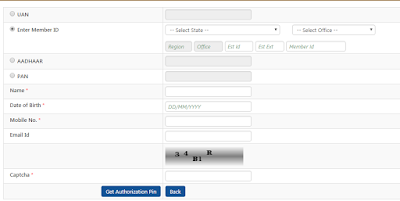

2) Select the Second radio button member ID [Member ID is your P.F number split the P.F number according to the permitted tabs in the member ID . Refer P.F number above if you have doubts]

3) Fill in the details with the mobile number you have linked Aadhar / pan

4) Select get authorization pin

5) You will get PIN to your mobile with which you can activate your pin

6) You can know your UAN Status by going to the Member Portal

Words from the author

It is better if you link the Aadhar because it will be made compulsory some time in the future ,also it has benefits to support the process as well .

P.F stands for Provident Fund ,an employee contributes 12% of basic salary & employer contributes 3.67% monthly . Also the employer contributes 8.33% to NPS (Pension) which is not as lucrative as the PF earnings in terms of returns

4) Select get authorization pin

5) You will get PIN to your mobile with which you can activate your pin

6) You can know your UAN Status by going to the Member Portal

N.B: You will have to keep a passport size photo & your signature ready (Digitally)

Once it is activated you can update your other KYC details , If you update your Aadhar details you have Major Benefits . Check the same and decide if you want the same . Auto Transfer of PF accounts as per Form 11 is the major benefit & it helps hugely in Withdrawal also

Updating Aadhar details in UAN

If you have reached at this point , the rest is a cakewalk

Once this is complete , you could check the PF passbook online

This is how your passbook will look like this

Words from the author

It is better if you link the Aadhar because it will be made compulsory some time in the future ,also it has benefits to support the process as well .

P.F stands for Provident Fund ,an employee contributes 12% of basic salary & employer contributes 3.67% monthly . Also the employer contributes 8.33% to NPS (Pension) which is not as lucrative as the PF earnings in terms of returns

Comments

Post a Comment